Ready to start filing your 1099-NEC forms?

Skip the forms and software, and file to the IRS using our online services. Simply create an account, enter your 1099-NEC data online, then instantly print IRS approved copies on plain paper – or save as PDF copies. Our team will e-File to the IRS for you.

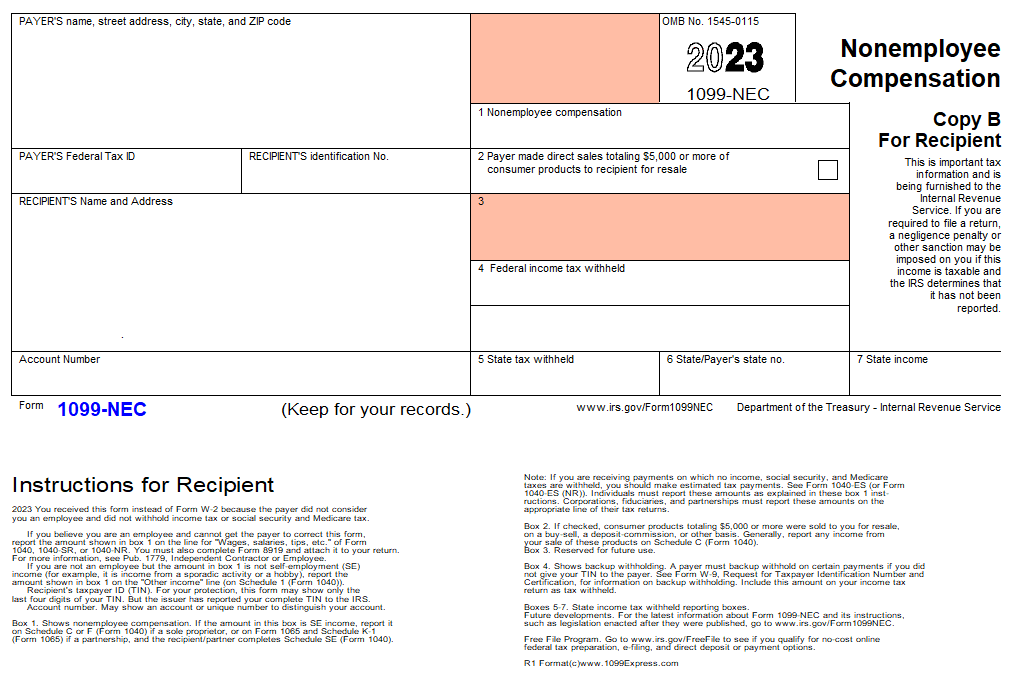

Before you get started filing, here is some basic information:

If you paid a contractor $600 or more to perform work for your business during the calendar year (Jan 1- Dec 31), then yes, the IRS requires you to report that amount paid on a 1099 NEC form. You are required to send the recipient a copy by Jan 31 and file to the IRS by Jan 31 to avoid penalties.

Official publication link – general instructions

Need to report nonemployee compensation from years past? No problem! Our online 1099-NEC information reporting service allows you to instantly create recipient copies and e-file forms – even from past years.

Simply click “start filing” to create a new account, or “login” to access your existing account. Once you’re logged in, create a New Company, and enter the tax year for which you want to file, along with the company issuing the form.

*If you are trying to create a previous year file for a 1099-NEC that is prior to 2020, you must use the 1099-MISC form. The 1099-NEC form did not exist prior to Tax Season 2020.

Next, enter the form data, checkout, create and mail your recipient copies – and you’re done!

WageFiling provides easy solutions for creating and filing corrections for 1099 Forms. If your company needs to make any corrections, we have you covered!

Take a look at the common errors below to identify which type of error was made, and how to correct. You can file corrections through us even if you filed in the past or with another company.

Type 1 and Type 2 as defined by the IRS. Let’s determine what type of correction you need to file.

Type 1 errors are straight forward. Usually, these errors include the wrong money amount being entered or money being reported that should hot have been reported.

To correct this type of error only requires one form or entry into Wagefiling. It’s important to always create a new file, enter the correct data, whether that is an adjusted amount or a $0.00 and put an X in the correction box. Pay for the file, print it out and get it to the recipient – we take care of the rest.

Type 2 errors get a little more complicated, but they usually involve a wrong name or TIN (EIN or SSN) but can also include the wrong amount.

To correct this type of error you must create 2 entries in Wagefiling. Again, create a new file and enter the wrong information that was originally reported, put a zero ($0.00) in the money box and put an X in the correction box-this “unfiles” the wrong information. Then create a new entry with all the right information. Pay for the file, print out the form and get it to the recipient – we take care of the rest.

Once you know what type of error you need to correct our program makes it easy!

Ready To Get Started?

We Make It Easy For Anyone To File 1099-NEC, 1099-MISC, and W-2 Forms