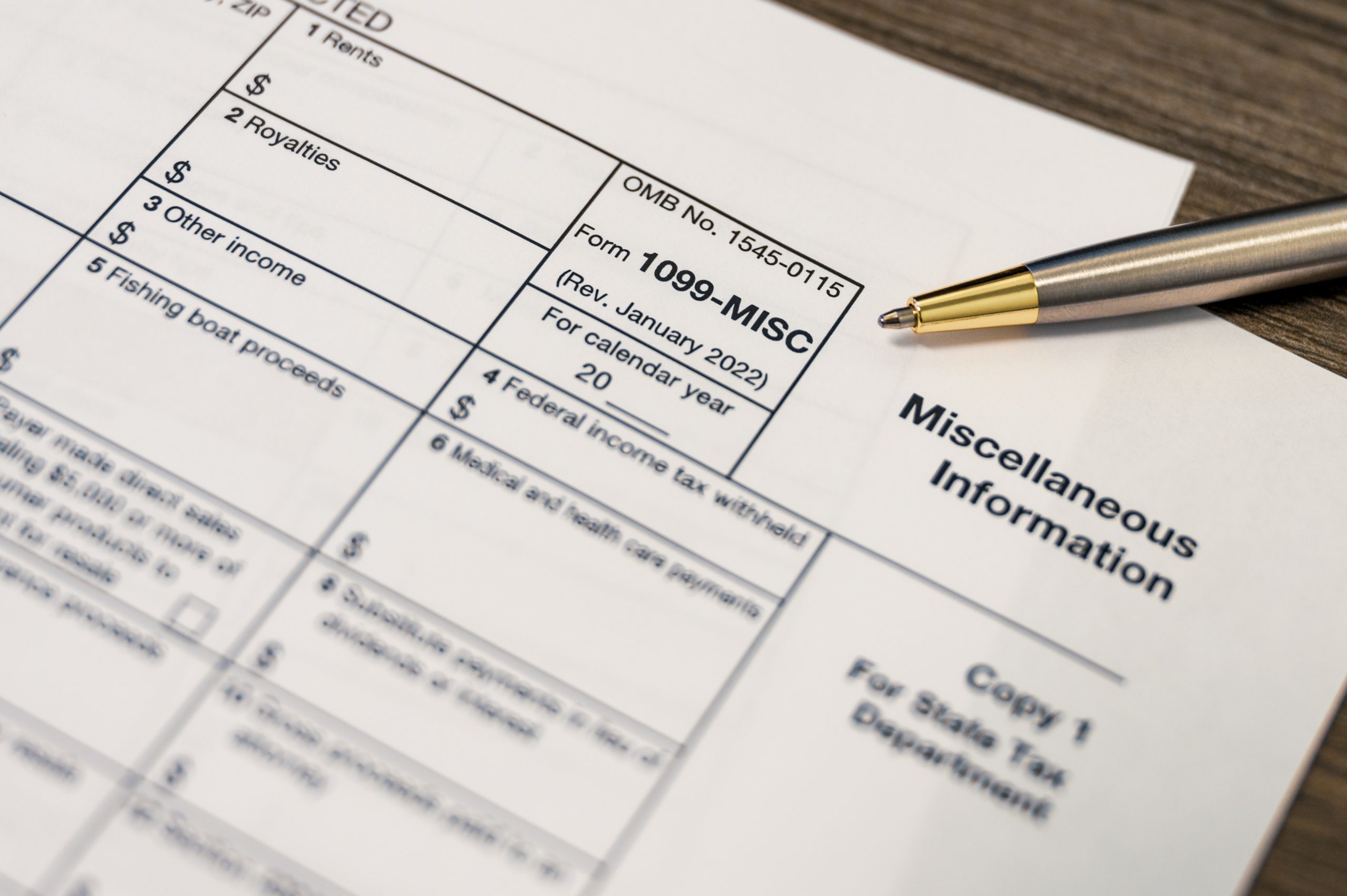

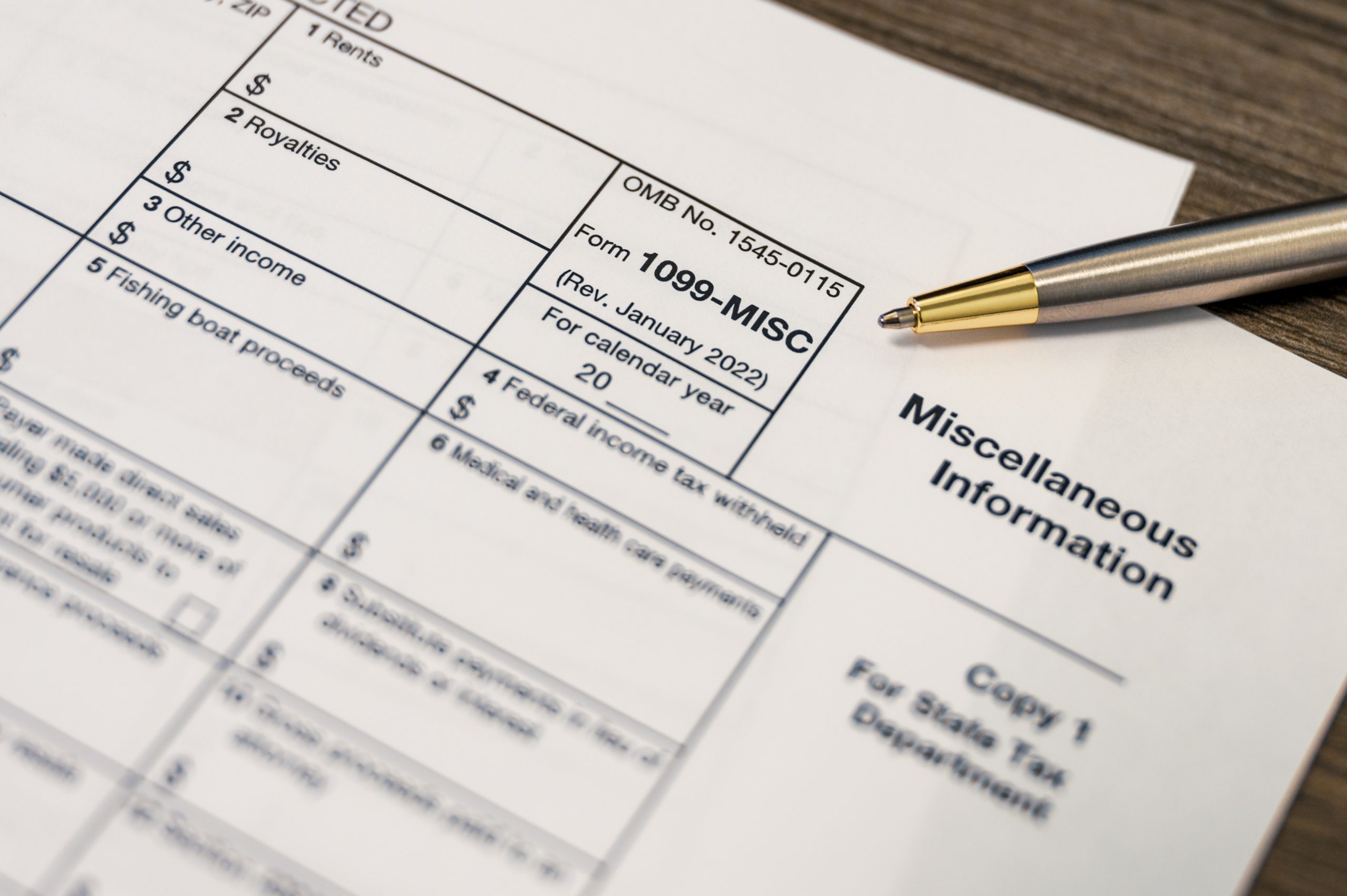

IRS Reduces Paper Filing Threshold for Information Returns

The Internal Revenue Service (IRS) has announced that it will lower thethreshold for filing information returns on paper from 250 to 10, starting fromthe 2023

The Internal Revenue Service (IRS) has announced that it will lower thethreshold for filing information returns on paper from 250 to 10, starting fromthe 2023

WAGE FILING © 2024 | All Rights

Reserved