A 1099 NEC form is only for reporting Non-Employee Compensation. This used to be reported on 1099 MISC in Box 7 but the IRS split it out from the MISC form. More than likely due to its requirement to be eFiled and mailed to the recipient by Jan 31st each year.

The 1099 MISC form has multiple payment options including rents, royalties, fishing boat proceeds, medical and health care payments and several more. This form has multiple due dates as well. The forms to recipients must be mailed by Jan 31st however you have until Feb 28 if mailing them to the IRS or March 31st if you are e-Filing. If you have money in boxes 8 or 10 you have until February 15 to eFile.

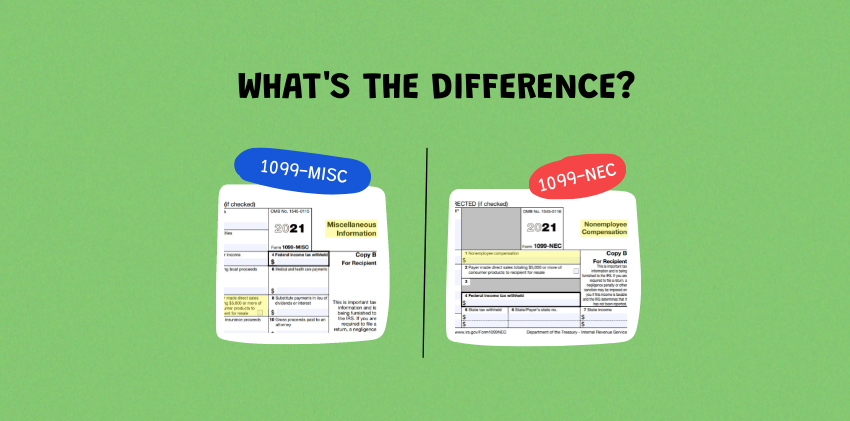

Understanding the Difference Between 1099 MISC and 1099 NEC Forms

When it comes to reporting income for tax purposes, it’s important to understand the distinction between the 1099 MISC and 1099 NEC forms. These forms serve different purposes and have specific requirements. In this blog post, we will explain the differences between the two forms, including their reporting categories, due dates, and e-Filing requirements. By gaining clarity on these distinctions, you can ensure accurate and timely reporting of income.

1099 NEC: Non-Employee Compensation

The 1099 NEC form is specifically designed for reporting Non-Employee Compensation. Previously, this category was reported on the 1099 MISC form in Box 7. However, the IRS separated it from the MISC form, likely due to the requirement of e-Filing and mailing it to recipients by January 31st each year. Non-Employee Compensation includes payments made to independent contractors or freelancers for services provided.

1099 MISC: Multiple Payment Options

The 1099 MISC form covers a broader range of payment options. In addition to Non-Employee Compensation, it includes other categories such as rents, royalties, fishing boat proceeds, and medical and health care payments, among others. This form has different due dates depending on the type of filing.

Due Dates for 1099 MISC:

When it comes to mailing the forms to recipients, both the 1099 NEC and 1099 MISC have a deadline of January 31st. However, for filing with the IRS, there are variations:

- Mailing to IRS: If you choose to mail the 1099 MISC forms to the IRS, the deadline is February 28th.

- e-Filing: If you opt for e-Filing, the deadline for 1099 MISC forms is March 31st. However, if you have amounts in boxes 8 or 10 on the form, the e-Filing deadline is February 15th.

It’s important to note the specific due dates to ensure compliance with IRS regulations.

Understanding the Differences for Accurate Reporting:

Differentiating between the 1099 NEC and 1099 MISC forms is crucial for accurate income reporting. Ensure that you use the appropriate form based on the type of payment made to the recipient. By adhering to the correct form and understanding the respective due dates, you can avoid errors and potential penalties.

In summary, the 1099 NEC form is exclusively for reporting Non-Employee Compensation, while the 1099 MISC form covers multiple payment options. Each form has distinct due dates for mailing to recipients and filing with the IRS, with the 1099 MISC form offering different deadlines based on the e-Filing option and specific box amounts. Understanding these differences is essential for accurately reporting income and complying with IRS requirements. By staying informed and using the correct form, you can ensure smooth tax filing and avoid potential penalties.